In November 2023, Encorp issued a complete Brand Owner Information Package regarding the planned transition of the New Brunswick Beverage Containers Program towards an extended producer responsibility (EPR) model on April 1, 2024. Encorp also held information webinars on this topic in December 2023, with repeats in early January 2024.

If you have not yet entered into a Brand Owner Agreement with Encorp in preparation for the new EPR Beverage Containers Program, or if you have questions or concerns, please note that you can access the webinar recordings, as well as the Brand Owner Information Package, including fillable PDF versions of all the required documents to complete and sign, via our website at encorpatl.ca/epr. The deadline for submitting the required documentation to assign Encorp as your agent for the new EPR Program was January 31, 2024. If your organization qualifies as a brand owner, and you have not yet signed and submitted the required documentation, we urge you to get this done as soon as possible.

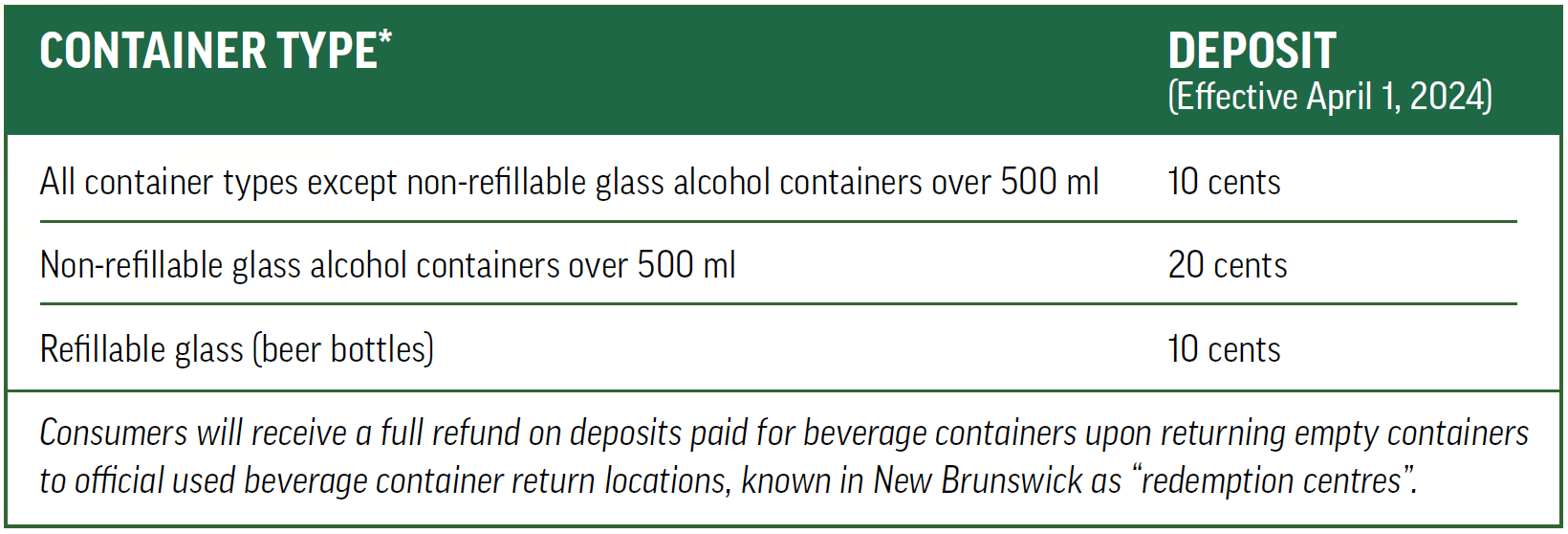

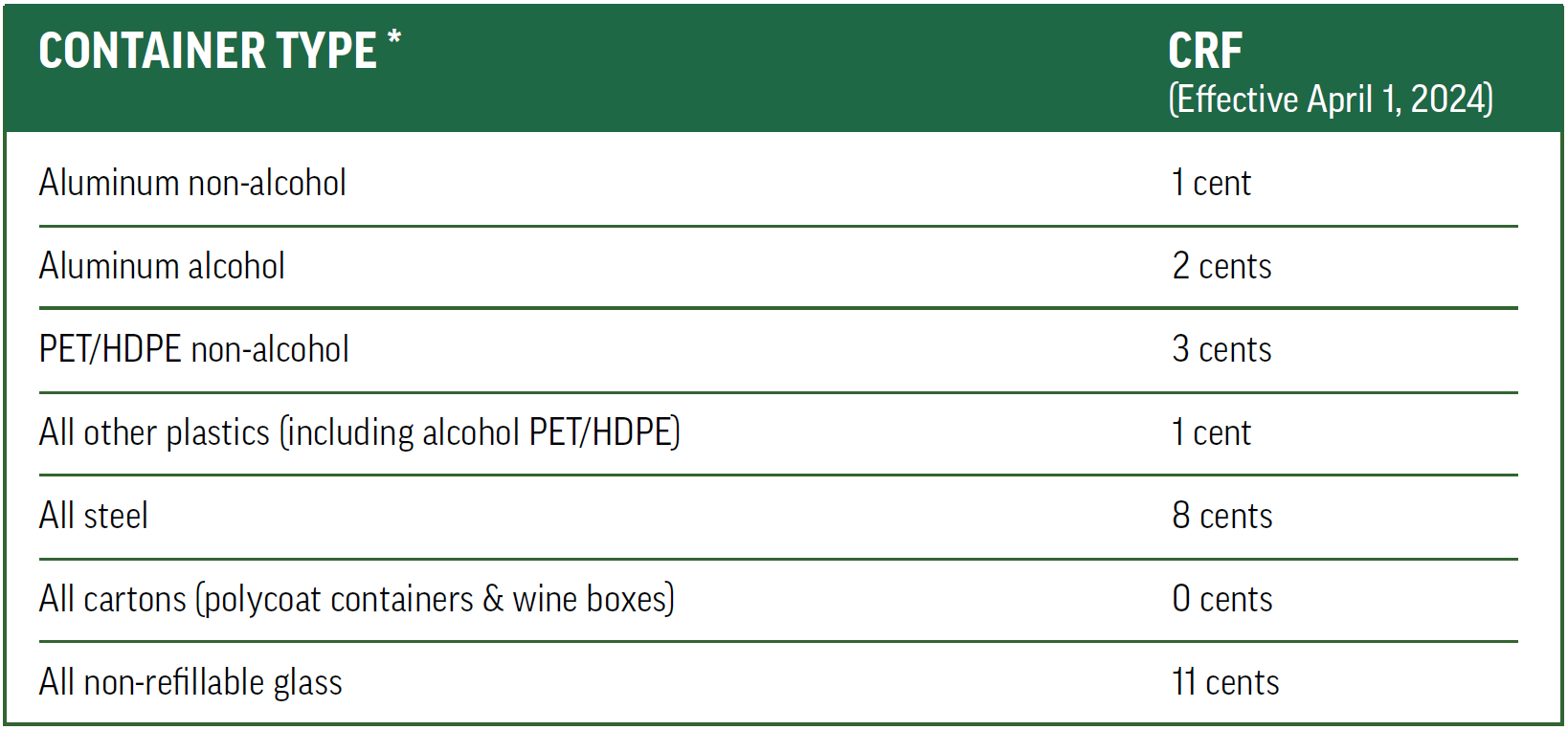

As noted in the information package, April 1 will bring changes in deposit values, as well as introduce a container recycling fee (CRF) on deposit-bearing beverage containers. The deposits and CRFs will be as follows.

*Will apply to all beverage containers up to a maximum of 5 L for products that fit the Regulation’s definition of “beverage.”

Regarding displaying fees, beverage product brand owners – including retailers of beverage products – should pay particular attention to the following.

- The only permissible “fee” retailers will be allowed to display as a separate line item on consumer receipts is the fully refundable deposit on the beverage container. Since the deposit must be charged to consumers separately from the price of beverage products and must be refunded in full to consumers when returning the empty container to a redemption centre, it should be listed as a separate line item on consumer receipts. Deposits should also be listed separately on business-to-business (B2B) invoices.

- Because deposits will be fully refunded to consumers starting April 1, 2024, they will no longer be subject to New Brunswick’s Harmonized Sales Tax (HST).

- Brand owners will be allowed – at their discretion – to absorb or pass on the CRF costs to retailers who, in turn, may absorb or pass these costs on to consumers. When passed on to consumers, the CRF must always be integrated into the total advertised sales price of a beverage container and the sales price of the beverage container on the receipt of the sale (i.e., it cannot be presented as a separate line item that is part of the point-of-sale calculation, including the subtotal, HST, etc.). However, this requirement for internalized fees will not extend to business-to-business (B2B) invoices. Recycle NB has produced guidelines to help decipher what is permissible and what is not regarding displaying CRFs, which are available on their website – recyclenb.com. Please contact Recycle NB should your company have questions or concerns regarding this topic. Encorp also has standard messaging about CRFs linking consumers to its website for more information available via its Retail Promotions Toolkit.

- Because CRFs are essentially a “service fee” charged by Encorp, they will be subject to New Brunswick’s Harmonized Sales Tax (HST), regardless of whether the beverage itself is taxable or non-taxable. HST will be calculated at 15% on top of the CRF amounts.