Deposits

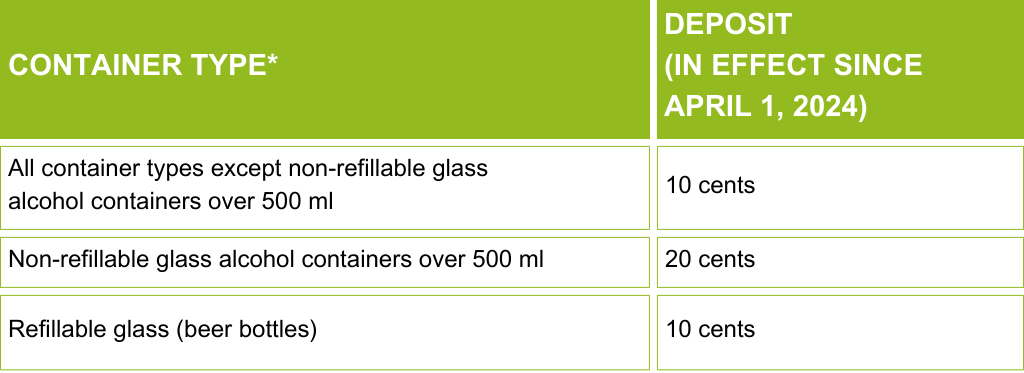

The New Brunswick Designated Materials Regulation requires the deposit/refund structure for beverage containers to be as follows.

“A retailer shall collect from a consumer, at the time of the sale of a beverage container, a deposit in the amount specified in the beverage containers stewardship plan under paragraph 65(b), which shall include any applicable federal and provincial sales tax.” NB Regulation 2024-37, section 66(1)

“The amount of the refund for an empty beverage container shall be equal to the amount of the deposit collected from a consumer for the beverage container.” NB Regulation 2024-37, section 66(2)

The deposit values are determined and set by Encorp Atlantic in its Stewardship Plan submitted to Recycle NB, as the producer responsibility organization (PRO) responsible for the extended producer responsibility (EPR) Beverage Containers Program.

*Applies to all beverage containers 5L and under for products that fit the Regulation’s definition of “beverage.”

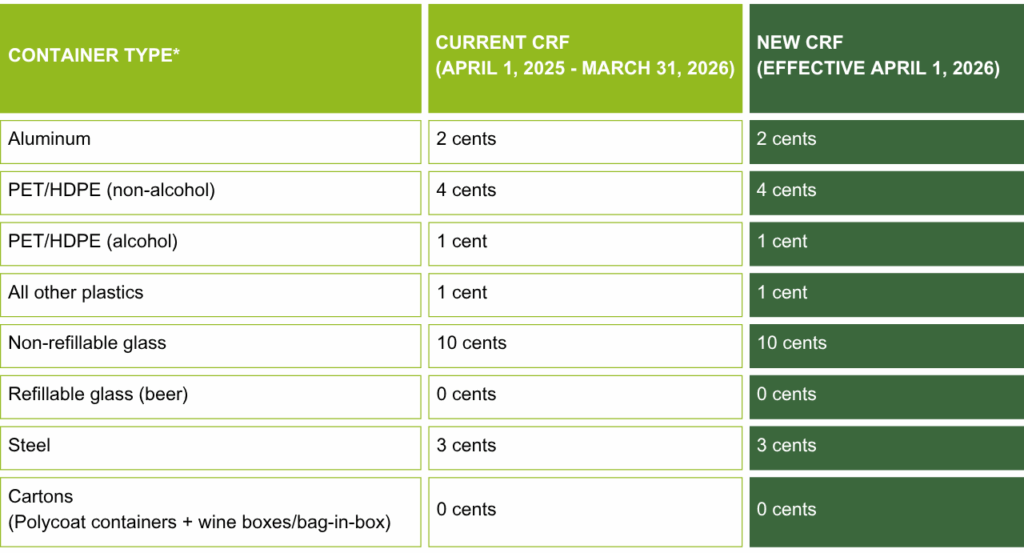

Container Recycling Fees (CRFs)

A container recycling fee (CRF) is established by Encorp Atlantic on container material types as needed to cover the estimated net costs of handling, transportation, processing, and administration for used beverage containers (UBCs).

Encorp, as a non-profit organization, regularly assesses the expenses and income associated with each type of container to ensure that the appropriate fees are applied. CRFs may be adjusted in the following two scenarios.

- If increased UBC recovery rates result in fewer unredeemed deposits, if commodity prices drop, or if there are increased fees for handling, processing, or transportation, the CRF can be increased to cover these additional costs.

- If there are additional unredeemed deposits or reduced collection costs, the CRF can be lowered to prevent the accumulation of surpluses in the account specific to that container type. However, account surpluses of lower-performing container types are used to promote awareness of those container types and increase their recovery rates.

The CRFs for each container type are provided below. Note that Encorp reserves the right to adjust the CRFs if needed at any point in time in response to unanticipated market fluctuations. Any changes to the CRFs are announced 90 days before they become effective.

***As of October 28, 2025, Encorp has confirmed that the CRF rates in effect as of April 1, 2026, will remain unchanged from the current rates — no decrease or increase in CRF rates is planned.***

*Applies to all beverage containers 5L and under for products that fit the Regulation’s definition of “beverage.”

Recovering Costs

The New Brunswick Designated Materials Regulation permits beverage product producers/manufacturers to recover the costs/fees related to their beverage container recycling program – meaning the CRFs charged by Encorp – at their sole discretion. However, these fees must be internalized – as stated below.

“Subject to subsection (2), a producer or a retailer on behalf of a producer may recover from the consumer the costs associated with implementing or operating a stewardship plan, including the administrative costs referred to in section 47.” NB Regulation 2024-37, section 50(1)

“A producer or retailer who recovers costs shall integrate those costs

(a) in the total advertised sales price of a designated material or a product containing or including a designated material, and

(b) in the total sales price appearing on the receipt of sale of a designated material or a product containing or including a designated material.”

NB Regulation 2024-37, section 50(2)

“A producer or retailer is not prohibited from informing the public that the total sales price of a designated material includes costs recovered under subsection (1) and communicating the amount of those costs to the public.” NB Regulation 2024-37, section 50(3)

Frequently Asked Questions on Deposits and CRFs

What is the difference between a CRF and a deposit?

A “CRF” stands for Container Recycling Fee. It is an environmental handling/management fee charged to the beverage industry to cover the estimated net costs of recovering and recycling the containers for their products. The exact amount set for each container depends on how cost-effective a container’s material type is to recycle. CRFs are a common and proven financing mechanism used successfully in many other Canadian provinces to fund the recycling of beverage containers. On April 1, 2024, the New Brunswick Beverage Containers Program transitioned to an extended producer responsibility (EPR) model, with a CRF set by container type to cover the estimated net costs of recycling each material stream.

A “deposit” is a refundable fee that consumers pay when they purchase a ready-to-drink beverage product in a sealed container, in addition to the item’s price. It is intended to encourage consumers to return the empty beverage container for recycling or refilling instead of disposing it in a landfill or as litter. New Brunswickers are accustomed to paying a 10-cent deposit on some containers and a 20-cent deposit on others. Since April 1, 2024, as required by the Designated Materials Regulation, they receive a full refund for these deposits when they return empty deposit-bearing beverage containers to designated used beverage container return facilities, known as “redemption centres.”

Isn’t the CRF just another form of taxation?

No, Encorp is a non-profit producer responsibility organization. None of the CRFs or the deposits go to any level of Government. The CRFs are charged by Encorp directly to the beverage industry to cover the estimated net costs of recycling their containers. CRFs are common in many other provinces and reflect the growing movement towards eco-packaging and producers taking responsibility for the lifecycle of their products. There are costs involved in recycling beverage containers, and charging CRFs to beverage producers is necessary to keep New Brunswick’s beverage container deposit/refund recycling system financially sustainable.

Is tax applied to the CRF?

Yes, the CRF is subject to New Brunswick’s Harmonized Sales Tax (HST), regardless of whether the beverage itself is taxable or non-taxable. HST is calculated at 15% on top of the CRF amounts.

Can I pass on the costs for the CRFs?

Encorp charges CRFs directly to the beverage industry (beverage product producers/manufacturers). Producers can, at their sole discretion, decide to absorb these costs, or pass them on to retailers. Likewise, retailers can choose to absorb these costs, or pass on these costs to consumers. When passed on to consumers, the Designated Materials Regulation states that the CRF must always be integrated into the total advertised sales price of a beverage container and the sales price of the beverage container on the receipt of the sale (i.e., it cannot be presented as a separate line item that is part of the point-of-sale calculation, including the subtotal, HST, etc.). However, this requirement for internalized fees does not extend to business-to-business (B2B) invoices. Producers and retailers should note the following helpful resources:

- Recycle NB has guidelines to help decipher what is permissible and what is not regarding displaying CRFs, which are available on its website.

- Encorp has standard messaging for consumers about CRFs which retailers can use available via its Retail Promotions Toolkit.

Is tax still applied to a portion of the beverage container deposits?

No. Tax is only applied to deposit portions that are not refunded to consumers. Because the Beverage Containers Program moved to a fully refundable deposit system on April 1, 2024, deposits no longer have a taxable component.

Why not raise the deposit amount on beverage containers in New Brunswick, especially when some other provinces have higher deposits?

Encorp aims to enhance customers’ used beverage container return and redemption experience in collaboration with local redemption centres over the next few years, improving access and convenience to recycling across New Brunswick before considering any potential increases in beverage container deposits.

Are there any types of beverage containers that are not included in the Beverage Containers Program?

Only sealed containers for ready-to-drink beverage products that fit the Regulation’s definition of “beverage” are included in the Beverage Containers Program and considered deposit-bearing. Deposit-bearing beverages should also be packaged in containers using material types from Encorp’s list of accepted materials. Additionally, containers greater than 5 L or containers that consumers can bring back to a retailer to be refilled (such as flagons/growlers) are not part of the Beverage Containers Program and are not subject to deposits or CRFs.