Deposit-Refund Structure

Under PEI’s revised Environmental Protection Act Materials Stewardship and Recycling Regulations, the Beverage Container Program will transition from a half-back model to a full deposit-refund model. Setting the deposit amounts is the responsibility of the PRO in its Stewardship Plan.

Retailers must collect deposits on beverage containers at the point of purchase, and consumers will receive a full deposit refund when returning empty containers for recycling at designated return facilities (PEI’s network of beverage container depots).

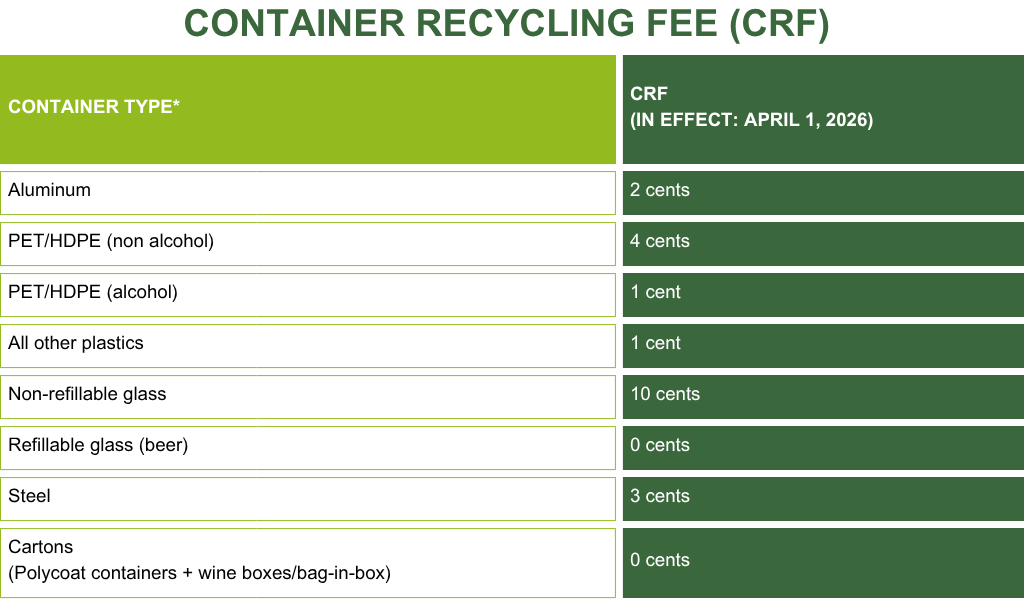

Effective April 1, 2026, the deposit amounts, established by Encorp in its Stewardship Plan, will be as follows.

*Will apply to all beverage containers 5 L and under for products that fit the Regulations’ definition of “beverage.”

- Deposits must — just as they always have — be charged to consumers separately from the beverage product’s price. They are required to appear as distinct line items on consumer receipts and may also be shown separately on business-to-business invoices.

- As of April 1, 2026, because deposits will be fully refundable when empty beverage containers are returned for recycling at beverage container depots, they will not be subject to PEI’s Harmonized Sales Tax (HST).

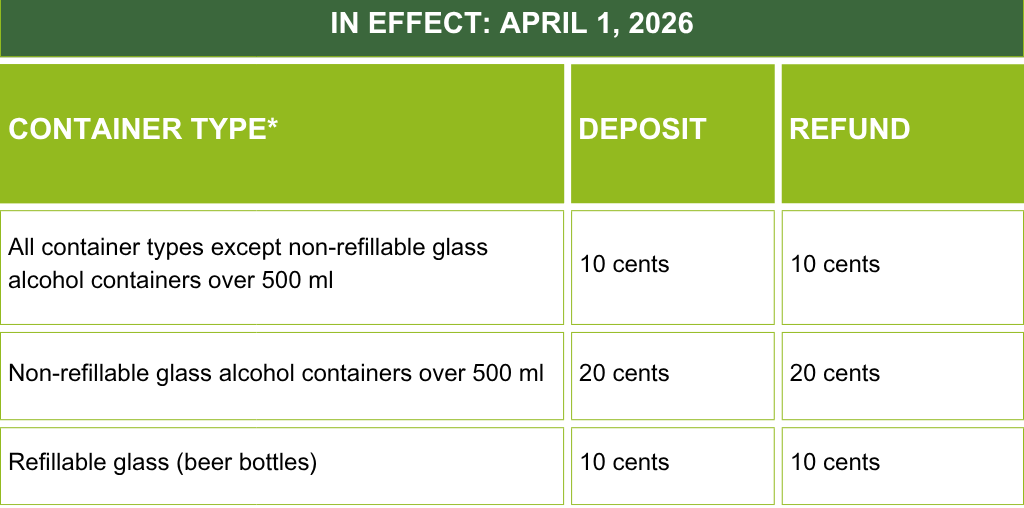

Container Recycling Fee

Effective April 1, 2026, Encorp will introduce a container recycling fee (CRF) on certain container types, as needed, to cover the estimated net costs of handling, transportation, processing, and administration of post-consumer deposit-bearing beverage containers. The CRF rates for each container type, effective April 1, 2026, will be set by Encorp as follows.